ActivTrades Reviews Read Customer Service Reviews of activtrades com

If you use Euro on a daily basis, it’s better to choose EUR as an account currency to save on conversion fees when withdrawing or depositing money. With robust regulatory oversight and a client-centric approach, they are a reliable choice for novice and experienced forex traders. According to research, ActivTrades is a brokerage firm based in the United Kingdom. Based on our expert findings and review, ActivTrades is considered a food and reliable broker with excellent trading conditions and state-of-the-art services including support and education. The broker is well-known as one of the best in the market with high score in customer satisfaction, also offering the lowest spreads on almost all asset classes while fees are relatively low or 0. ActivTrades is a UK-headquartered CFD and forex broker established in 2001.

- The Financial Services Compensation Scheme will compensate eligible clients up to £85,000 for an investment firm that has failed.

- Low trading fees are one of the most important features when it comes to choosing your next broker.

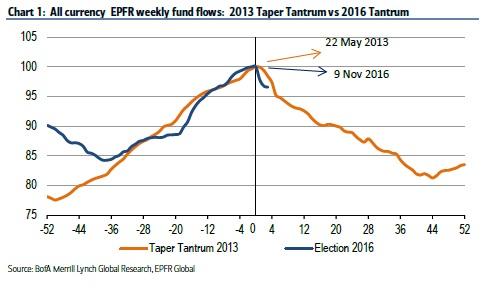

- The VIX, often called the “fear gauge,” is a volatility index representing the stock market’s expectations of volatility over the next 30 days.

- Alternatively, if you opt for the professional client account, the minimum deposit requirement is 2,000 Euro.

- By 2008 it added CFD trading on financials, indices as well as commodities.

In addition, they help monitor your positions from anywhere on the globe where there’s an internet connection. MetaTrader 4 is a widely known trading platform used by Forex traders globally. As a result, you can find vast amounts of algorithms or Expert Advisors developed for this software. Low trading fees are one of the most important features when it comes to choosing your next broker. It’s safe to say that ActivTrades offers some of the best prices in the industry. You will also be able to choose a trading account currency out of USD, EUR, GBP, and CHF offered.

Spreads on the popular index, S & P 500 (or US 500) start from 0.23 pips. ActivTrader, the proprietary trading platform, provides a sound choice for manual traders. The company structure includes a board of directors, which oversees the business’s day-to-day operations.

Positions can be opened in just a few clicks on each of the trading platforms. Investors will usually need to enter the number of lots they wish to trade, as well as set any advanced order types such as take profit or stop loss. Although there is no deposit bonus or rewards scheme, ActivTrades does have a cashback programme, through which investors can receive a 20% reduction in spreads, commission and swap rates.

ActivTrades offers 24/5 customer support through live chat, email, and telephone in multiple languages. It is important to note that no risk management tool can guarantee a profit, and traders should always use them in combination with a sound trading strategy. Traders should also make sure to understand the terms and conditions of these tools before using them. Thorough market research is essential to a lucrative trading experience. The analysis is used by traders to identify trends, understand the market drivers, price movements, short and long-term resistance, and values. Additional insurance that covers up to $1 million, is also offered to traders.

💵 ActivTrades Minimum Deposit :

With its advanced technology and outstanding customer service, it is easy to see why ActivTrades has received such positive reviews from traders worldwide. Despite having developed a proprietary trading platform, ActivTrades demonstrates their commitment to the MT4/MT5 trading platforms with seven unique add-ons available for all live accounts. The upgraded MT4 allows traders access to a more superior gateway than that which activtrades forex review is provided in the proprietary ActivTrader. The add-ons, labeled Smart Tools, include automated chart pattern recognition, which is a tremendous tool, especially for retail traders who may lack resources and access to a proper trading team. Smart Tools represents the most valuable asset this broker provides. DailyForex.com adheres to strict guidelines to preserve editorial integrity to help you make decisions with confidence.

ActivTrades provides access to various educational materials including seminars, one on one training, webinars, a webinar archive, a trading glossary, educational videos, and educational manuals. Moreover, the broker provides an economic calendar and in-depth market analysis to its clients. The minimum initial deposit required for an Islamic account is $500. On the downside, traders do not have access to the ActivTrader software. Only MetaTrader 4 and MetaTrader 5 are available for this account. In this regard, ActivTrades is an exception as the broker only offers 2 types of live accounts, one of which is an Islamic account.

Compare Trading Instruments

Please note that the standard timeframe and bank wire transfer fees may change. The broker does its best to process requests within the given timeframe, however, there might be some delays. Following industry standards, new accounts are opened via an online application.

Unique Features

The apps maintain functionality without sacrificing essential features, offering real-time charting, trading execution, and management wherever traders find themselves. ActivTrades does not impose withdrawal fees, ensuring traders can access their funds without additional charges. Recognizing the importance of inclusivity, the broker also facilitates Islamic (swap-free) accounts that adhere to Sharia principles. ActivTrades runs a reduced schedule on bank holidays in line with global financial markets. More information regarding specific changes is available on the broker’s website.

ActivTrades is a broker that offers risk management tools such as stop loss orders, guaranteed stop loss orders, and negative balance protection to help traders manage their risk while trading. These tools allow traders to limit their potential losses on a trade, which can help them to stay within their risk tolerance levels. The regulating bodies ensure safe trading conditions such as segregated customer funds and the best trading practices. Forex brokers make money by charging traders commissions per trade or spreads. Commissions are the fees the trader pays the broker for handling the transaction and is mostly dependent on the instrument and account type.

Customer Service

I don’t think activtrades requires any introduction, because they are experts at delivering financial services for all who wish to dig deep in this field. They have a good selection of trading platforms, quite informative and useful webinars, big array of assets across different classes and so on. I bet you will find something up to your taste and will enjoy the pastime here. Overall, ActivTrades adheres to all regulating rules in order to offer customers a positive trading environment and keep customer funds safe.

The broker has a market blog and data to enable investors to analyse the financial state of the economy. Economic calendars are another useful tool to identify upcoming market events that could cause a shift in the price of an asset. First, always choose a market you are familiar with and have a decent knowledge of. Investors must understand what causes prices in particular markets to shift if they want to build a successful strategy.

MT5 comes with enhanced backtesting robots and offers DoM (Depth of Market) capabilities. The DoM feature helps traders analyze bids and ask prices and make more informed decisions. Please keep in mind that some intermediary banks might also charge the commission fee.

ActivTrades offers access to trading the 16 most popular crypto CFDs, including BTC/USD, ETH/USD, LTC/USD, BCH/USD, DOT/USD, EOS/USD, LINK/USD, XLM/USD, NEO/USD, ADA/USD, and DOGE/USD, etc. For withdrawals, the methods available are the same as the deposits, however, there are charges for Non-Sepa bank transfers(15EUR) and 12.50EUR for USD bank transfers. ActivTrades are a long-standing broker in the industry, regulated by the FCA. On the first look, the website is logically set out, and information on this broker’s services can easily be found. The presence of an FAQ page and 24 hour/5 support is also nice to have.