Intraday currency option trade calculator with currency option greek

Contents

Name, PAN, Address, Mobile Number, Email id and Income Range have been made mandatory. Investors availing custodian services will be additionally required to update the custodian details. In case of any dispute between the MFIs and the investors arising out of the BSE STAR MF platform, BSE and / or ICCL agrees to extend the necessary support for the speedy redressal of the disputes. The client has read and understood the risks involved in investing in Mutual Fund Schemes. Investors may please refer to the Exchange’s Frequently Asked Questions issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard.

Foreign currency options are options on foreign currency pairs like the USDINR, GBPINR, EURINR etc. That is because volatility and time make the call and put valuable as they increase. Unlike the equity option where we used the risk-free rate, in the case of the currency option, we look at the movement of interest rate differential. In the case of USDINR, you track the difference between the US risk-free interest rate and the Indian risk-free rate. This will represent the interest rate differential depending on which currency pair you are buying the option on.

What is forex options?

LO/BO/PO, NRO Accounts, Foreign Currency Account, Special non rupee resident account . Account specifically designed for government suppliers, vendors and contractors with no minimum MAB. An end-to-end solution for startup founder which includes tailor made bundled products, consulting and advisory services and gives you network to help your business grow. Apple’s contract manufacturers and component suppliers have together created nearly 50,000 direct jobs in India since the smartphone production-linked incentive scheme came into effect in August 2021, government officials said.

Open interest shows the number of lots of the specific contract that are still open in the market at this point of time. To get access please email on from your registered email-id or contact you Relationship Manager. Not only this, if one compares the statutory cost, currency has the lowest charges. The client shall be wholly responsible for all his investment decisions and instruction. 30-day online access to the magazine articles published during the subscription period.

“KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.” Cross currency pair trading allows you to diversify your portfolio. It allows traders to profit from both differences in interest rates at different economies as well as from exchange rate disparities. But it takes some practice to trade with confidence since it also involves high volatility. Speculators too can take advantage of the changes in the value of a currency.

Currency Put

Offers customised Hedging solutions to clients by structuring using Interest Rate and Foreign Exchange products like Swaps and Options. An innovative digital platform to execute escrow transactions online. Invest in India through our one-stop solution, offering pre and post incorporation services along with a range of banking and business services. We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties.

Valuation of currency options is also done using the Black and Scholes model which uses the volatility based pricing logic. There is also the binomial model where the answers are less authentic. Over-the-counter options or OTC options are privately traded options that are traded on a recognized stock exchange. OTC options are not standardized nor do they carry the counter-guarantee of the.

Strike price intervals

Intrinsic value is fairly straight forward because it is measured by moneyness. Time value of the option is one of the most important concepts and helps in options trading. “Introduction of currency options has been long awaited by market and is definitely a step in the right direction,” United Stock Exchange CEO T S Narayanasami said. Exchanges are enthusiastic about the launch of currency options and said the approval has been long awaited by market. For cash, currency, future & options, commodity derivatives segments of exchanges.

However, the problem is each passing day erodes the price of an option — theta. The option’s delta —change in option price relative to change in underlying dollar -rupee rate — has to overcome the theta for a buyer to gain. So the call seller charges higher premia to factor this in. NSE offers 11 serial weekly contracts expiring on Friday, excluding the expiry week wherein monthly contracts expire on a Friday. New serial weekly options contracts are introduced after expiry of the respective week’s contract.

Cross clearlight private equitys are denominated in the principal currency that is the first currency of the pair. However, the option premiums even for cross currency options are denominated in rupees only. Call and put options on the USD-INR pair that can be purchased through your stockbroker or through your internet trading platform. The options are European, which means you can only use them till they expire.

Notice from the above table that the seller would make money as long as the spot price is above the breakeven price. Once the spot price crosses underneath the breakeven price, the seller will start making losses.The chart below shows the visual representation of the short put payoff. This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. The fraudsters are luring the general public to transfer them money by falsely committing attractive brokerage / investment schemes of share market and/or Mutual Funds and/or personal loan facilities.

- Selling an option is similar to selling a futures as far as the cash outflows at the time of selling the option are concerned.

- Currency Futures and Currency Options refer to a standardized foreign exchange contract traded on a recognized stock exchange.

- Update your mobile numbers/email IDs with your stock brokers/Depository Participant.

- So the company decides to purchase 10,000 USD forex options at the current exchange rate of Rs 70.

- In the case of options, while the lot size is denominated in the international currency value, the premiums are denominated in Indian rupees.

In this chapter, we will exclusively focus on intermarket analysis i.e. how movements in bonds, commodities, and equities impact movements in currencies. In case of options position, if the Dollar depreciates, the importer would lose to the extent of the option premium that he has paid, but he would gain on the spot segment, in which he would be making the payment. On the other hand, if the Dollar appreciates, the importer would gain in the options segment, which would help him offset the losses that he would make in the spot segment. So, as we can see, while options limit the losses, they do not limit the profit potential.

While RBI approves the products, SEBI decides on the trading platforms. In this chapter, we will show how to use Technical Analysis in analyzing currency trends. We will also see how to establish reward-to-risk ratio using charting patterns. For a robust understanding of Technical Analysis however, we suggest one to go through our Technical Analysis module.

Currency Options Brokerage Calculator

When the spot price, however, goes above the breakeven price, the seller would start incurring losses. You can buy and sell https://1investing.in/s through your regular trading account and you just need to activate trading once in these contracts. They can be traded in currency pairs just like your equity interface. Like in the case of currency futures, you have rupee pairs and cross currency pairs in currency options too.

This chapter has been written with the assumption that the reader has a basic understanding of Technical Analysis. For mergers and acquisitions; Exit Offers-Delisting & Open Offer, InvIT, REIT & Buybacks and other complex transactions. Leading Bankers to the Issue and collecting bankers for all types primary market issuances. Our Debt Syndication Desk offers end-to-end services related to the origination and placement of bonds & commercial papers across various Issuer and Investor segments. Supplying physical Gold/Silver to Bullion traders and jewellery manufacturers by way of Outright sale and Gold Metal Loan products.

Investments in securities market are subject to market risk, read all the related documents carefully before investing. So, what about the risks involved in cross currency trading and how you can hedge against those. On submission of the necessary information to the stockbroker and updation of the same by the stockbroker in the Exchange systems and approval by the Exchange, the blocked trading accounts shall be unblocked by the Exchange on T+1 trading day. Since ATM options are practically difficult, traders consider the two contiguous strikes as near the money , which is an extended version of ATM options. The contract is a call option the USDINR contract expiring on 28thAugust having a strike price of Rs.71.50. It allows traders to leverage trades because the premium cost of the option contract is very cheap compared to the cost of actually buying the contract, allowing them to take a large position for a small premium.

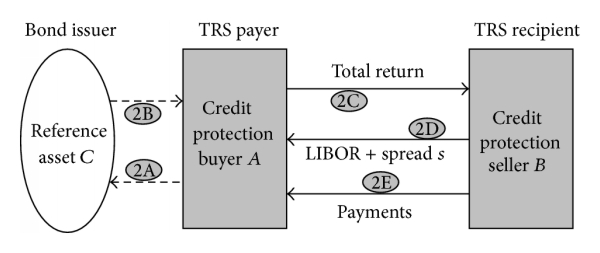

Let us understand what is options and currency options meaning in the context of the currency derivatives market in India. The currency options definition is exactly like any other option except that it is on a currency pair. The principal for the same amount is traded at year 0 and interest payments are made by the counterparty over the course of the term.

The Black and Scholes model uses a five factor model to value options. The table below captures the gist of the model parameters and how the factors impact the call and put options. Since the premiums are relatively cheap, you can use a lot of leverage and trade in enormous volumes. This is because of the fact that you can trade a multiple of the premium. Please note that by submitting the above mentioned details, you are authorizing Kotak Securities & its authorized persons to call you and send promotional communication even though you may be registered under DND. All calls with KSL representative may be recorded for internal quality and training purposes.

Expenses in connection with foreign travel, education and medical care of parents, spouse and children. For more information on Currency Futures and Options or to register please call us at our Corporate Customer Care numbers. The product follows normal Futures and Options (F&O) rules and regulations of the exchanges. Seamless integration of Pre-trade, At-trade and Post–trade services under one roof.

Treasury – Currency Options

You may be already trading futures and options with stocks, or directly in equity. With futures and options, you do not need to open a demat account, but besides that fact, you can diversify your portfolio and earn rewards. Talking of portfolio diversification, you can check out any of the upcoming IPO offerings too.

TRADEBULLS SECURITIES PRIVATE LIMITED

It allows the option buyer to exercise his right to buy the currency pair at the predetermined strike price on or before the expiration date of the contract. If the currency pair is below the Strike Price when the option expires, the option is worthless, and the option seller would keep the premium. Selling an option is similar to selling a futures as far as the cash outflows at the time of selling the option are concerned.