The fresh new qualifications requirements for finding a beneficial 2 hundred dollars financing can be simple

The fresh new recognition fee is quite large, and more than customers have the need count. not, you have got to meet several earliest standards so you’re able to be eligible for a beneficial $2 hundred cash advance, such:

- Getting 18 years old or earlier

- Become a citizen otherwise a long-term citizen of one’s You.S. which have an enthusiastic ID

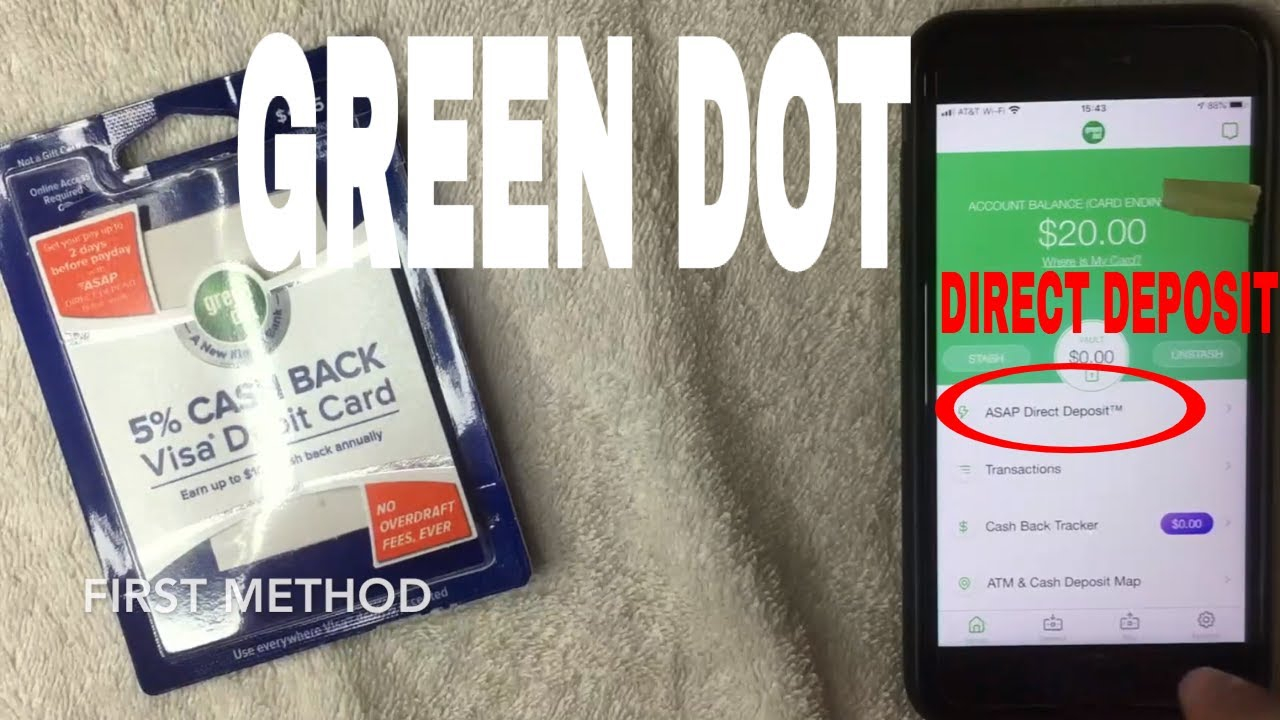

- Has a constant way to obtain newest money

- Has actually an energetic family savings

- Features an elizabeth-mail and you may contact number

The fresh eligibility conditions can differ based a state guidelines or the financial institution. Yet not, $two hundred payday loans deal with demands out-of http://www.cashadvancecompass.com/payday-loans-ar/augusta applicants with worst or bad borrowing from the bank.

Could you Get a great 2 hundred Dollar Financing that have Bad credit?

If you would like rating a great two hundred dollar loan quick, regardless of whether you really have a poor credit get. Pay check lenders don’t think about your credit score whenever checking the loan demand form. Rather, they generate sure you really have a current, constant income source one demonstrates your capability to repay the loan on time. Read more