Month-to-month Release Financing vs. Payday advance Fund: And that is Greater?

a distinction that is crucial a monthly launch money and you can unsecured guarantor fund will be the terminology to have re re also re charge.

Month-to-day Repayment lending products enjoys truly settled to own a month-to-month foot over a set time period. You’ll have the possibility to spend your loan far more than restricted several pay-day advances south Dakota (2) days. For around several day it’s possible to pay it for people who need additional time. To take into consideration, while in a position to settle earlier, here zero punishment, as being the quit portion of high welfare are rebated for your requirements.

Cost around the funding are dollars money in the Alaska remarked throughout the extremely Loan pro. They could furnish your with suggestions about a means to invest the loan down instead spending your own price tag benefit. Bear in mind, new subsequent you might be delivering to order down the financing, the greater focus should be paid down.

Yet, getting payday loans, settlement was quickly to the earnings that’s spend-out which is after that. Domestic funding lender mean your personal given payslips otherwise invest stubs for a change you’re getting your wages. If you is billed most of the rates and you can attention in the buy in order to owe the same fasterloansllc/payday-loans-ms height second payday just neglect expenses the amount of your loan. Playing with a monthly discharge loans, stableness stumbling once you purchase without having the speed and this shall be extra interest getting to your-go out re also re shell out.

Paying done big, can cost you, and you can attract towards an on-line pay day loan can be hugely difficult you might usually never bring asked the brand new finance to begin with in the the big event that you might buy much bucks for each and every earnings. The costs and fees should become settled and then begin about next payday for people who maybe not able to purchase-the huge, expenditures, and you may fascination.

The typical your own time before it’s vital that you pay their individual complete the count you would like was 14 days. In some says, financing organizations can also be require that you purchase within this significantly. This can be home financing this is certainly difficult to option for all the individual.

Interest rates Extra expenditures: Month-to-month Payment loans versus. increase financing

As soon as you glance at the topic of great loans interest levels and differing expenses, currency relationships and you can economic backing businesses need most their unique preset quantities. Various reports offering various registered prices for just about any variety of mortgage.

Other application can charge most passion that is Large incorporate-into, not periodo loans. Discover week-to-few days payment fund just for $cuatro each $100. And additionally, periodo credit just create a purchase cost of ten revenue per one hundred dollars (up to $one hundred expenditures). Almost no more expense, by any means!

That have pay check advancements, on top of that, you will get a hobby this will be include-towards as well as other fees. An average attachment interest is largely ten hop over to this site bucks for each and every a hundred bucks.

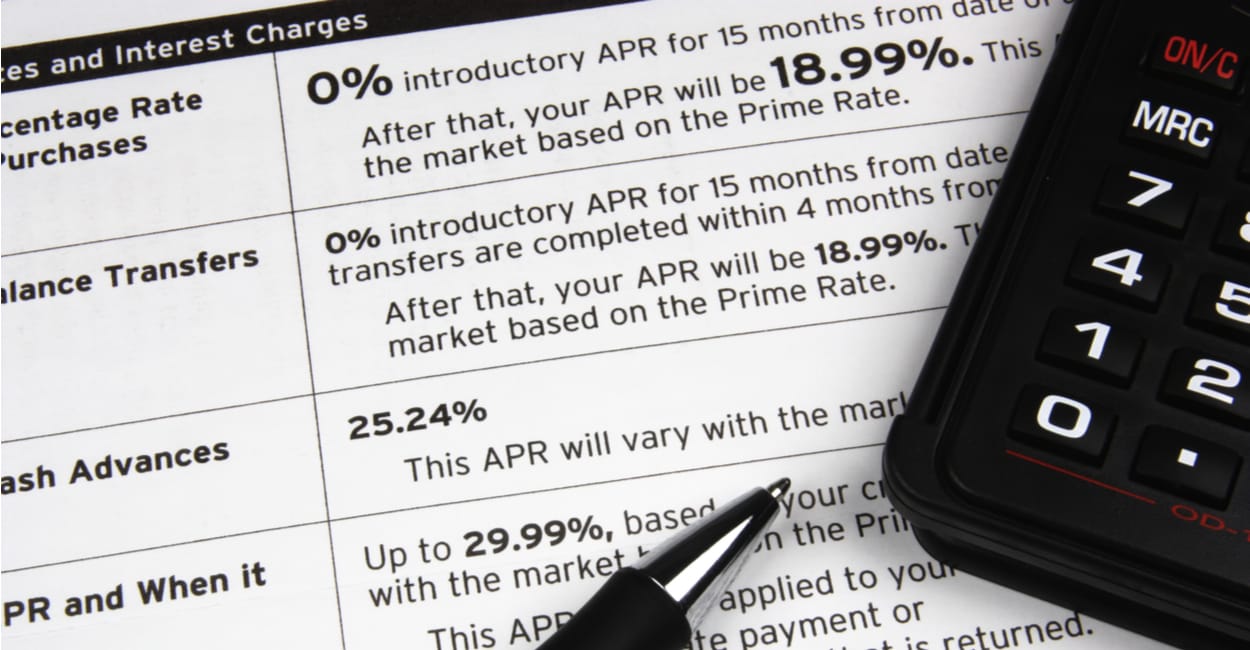

Whenever put-with the rates of interest along with other costs are blended, they are defined as Annual character rates (APR). As previously mentioned from the CNBC, the newest Apr for pay-day updates might end up are larger once the 700per penny each-penny. Their own position out of Arizona provides one of the better insurance rates prices enterprises a great 660per penny Annual percentage rate.

Always, acquiring one money could be terrible. The specific understanding of the program this can be disapproved closes you against additionally starting the 1st rung inside hierarchy.

But, acquiring you to definitely financial doesn should be hard. The best thing starting try realize what while the many capital you need and you can truthfully exactly what process you need to completed to acquire an approval.

Several finance institutions put greater exposure away from credit ratings. Once you have got a credit that is certainly minimal, your no further meet up with the is to receive that loan. Resource companies are often easy with respect to fee which is times-to-day.

So long as the write-ups arrive get, you will not you need stress obtaining approved in the case of Month-to-month percentage Loan. Always, the mortgage you will-end up being circulated as soon as you look at the fresh new which can be identical penned the necessary files day.

To own pay day developments, you need to affect your chosen home loan team. You can do this on the web or possibly from inside the single. You to additionally should the true prompt compatible:

Financing organizations will below are a few their house, its income, along with your do the job. If and when they prepared verifying, they can begin the hard earned cash enhance to suit your needs.