Capital Tips having Basic-Big date Homebuyers in the Georgia

Buying your very first home is an experience laden with adventure and you can anticipation, although procedure also can become challenging and often outright scary. Fortunately to possess potential real estate buyers in the Georgia, there are lots of applications accessible to assist very first-date homebuyers see the procedure and even help with the funds.

The fresh U.S. Agency regarding Casing and you will Metropolitan Advancement (HUD) has the benefit of counseling services to assist basic-big date homeowners greatest see the homebuying techniques. HUD-recognized counseling companies render each one of these services 100% free. Particular agencies supply on the internet studies programs and that, if completed, helps you accessibility specific very first-go out homebuyer loan software.

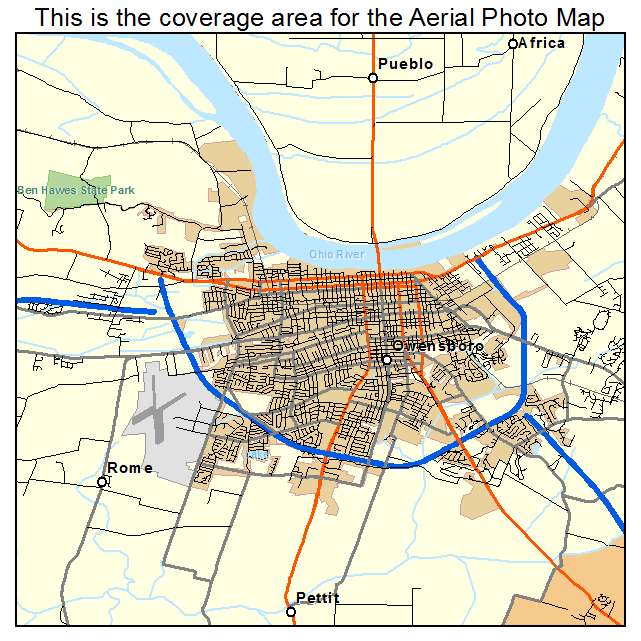

Getting qualified to receive it taxation borrowing you really must be to shop for a house within the a beneficial directed urban area

- Georgia FHA Money: These finance is actually covered because of the Federal Casing Administration in addition they give earliest-date homeowners an easily affordable downpayment (step 3.5%). But not, borrowers will need to purchase mortgage insurance policies (MIP) and this functions as safeguards with the financial should you default with the the mortgage. Financing restrictions are different predicated on state and therefore are determined based on the brand new median house rates regarding area. While there aren’t any money constraints to be eligible for an FHA financing, you will need to meet up with the financial obligation-to-money rates anticipate by FHA.

- USDA Rural Homes Financing: As you do not need to become a primary-go out homebuyer so you’re able to be eligible for that it financing program, it’s still a good choice for homebuyers of any sort lookin to buy a home within the outlying Georgia. That it mortgage also offers one hundred% money, zero deposit, and you will 29 season lowest fixed speed loans, among other things. There are kind of USDA mortgage loans. Funds getting solitary-family home was getting being qualified reduced- and you will moderate-money individuals. Earnings limitations vary by area and family dimensions. Discover the income standards to the USDA’s website.

- Housing Possibilities Discount (HCV): The brand new HCV was funded by HUD while offering assistance to reasonable-money household to assist them to change regarding renting so you’re able to getting. Become qualified, applicants have to be a recent HCV New member inside an effective updates. Applicants must satisfy minimal earnings requirements and possess continuous full-big date employment to have a year. Household applying for this discount are expected from the HUD and work out at least advance payment regarding step three%, having at least step 1% of this percentage coming from individual resources.

Becoming qualified to receive so it taxation borrowing from the bank you need to be to find property when you look at the a focused city

- Homestretch Downpayment Direction System: The latest Gwinnett County Government’s Homestretch Advance payment Assistance System has the benefit of qualifying first-date homeowners as much as $eight,five-hundred of guidelines. This will come because the a no-focus financing which have deferred repayments. In order to qualify, homebuyers must satisfy certain requirements as well as good FICO credit score off 640 and a loans-to-earnings proportion regarding 43% or all the way down. Purchase price limits incorporate and also the completion off an 8-time homebuyer pre-buy category.

- Georgia Fantasy Homeownership Program: Georgia’s Service of Society Circumstances will bring financial assistance so you’re able to homeowners as a consequence of the fresh new Georgia Dream Homeownership Program. Qualifying applicants are eligible to own deposit help of as much as $5,100. Homebuyers must get a property from inside the a targeted city and fulfill earnings and get rate constraints.

- Georgia Fantasy Toughest Hit Loans (HHF): Made for first-go out homeowners who’ve educated monetary pressures, the fresh HHF even offers $fifteen,000 for every house given that a beneficial forgivable loan with no attract otherwise monthly obligations. After 5 years, the borrowed funds was forgiven and will be used getting downpayment otherwise closing costs. So you’re able to be considered you need to reside in a designated county, features a credit history out of 640 or higher, do not have crime beliefs before ten years, and also you need certainly to safer your financial through the Georgia Dream Homeownership system.

Georgia now offers an income tax credit to have first-date homeowners. The MCC will help the latest borrower to help reduce the government income income tax liability and you may growing the being qualified money.

These types of areas meet particular conditions related to median loved ones income otherwise were considered as the an enthusiastic part of chronic financial be concerned. In addition, to be considered a primary-go out homebuyer, you can’t possess possessed property because the a main house when you look at cash loans in Brook Highland the history 3 years. Discover subsequent limitations getting qualifying listed in the latest MCC Program Book.

While a possible basic-date homebuyer during the Georgia, you should know there are lots of apps available to choose from so you’re able to make the processes easy and sensible.