Physician Mortgages | Simple tips to Save on Mortgage loans to possess Doctors

Delivering medical practitioner mortgages may seem counterintuitive, unless you’re an alternative doctor, thriving house, stuck with student loans and you may secured having time. Therefore, you’ll need let each step of your own method. Whenever you are then collectively on the industry, you may be looking to relocate to a bigger family or yet another neighborhood if not re-finance your current home loan. There can be help you here to you personally, too.

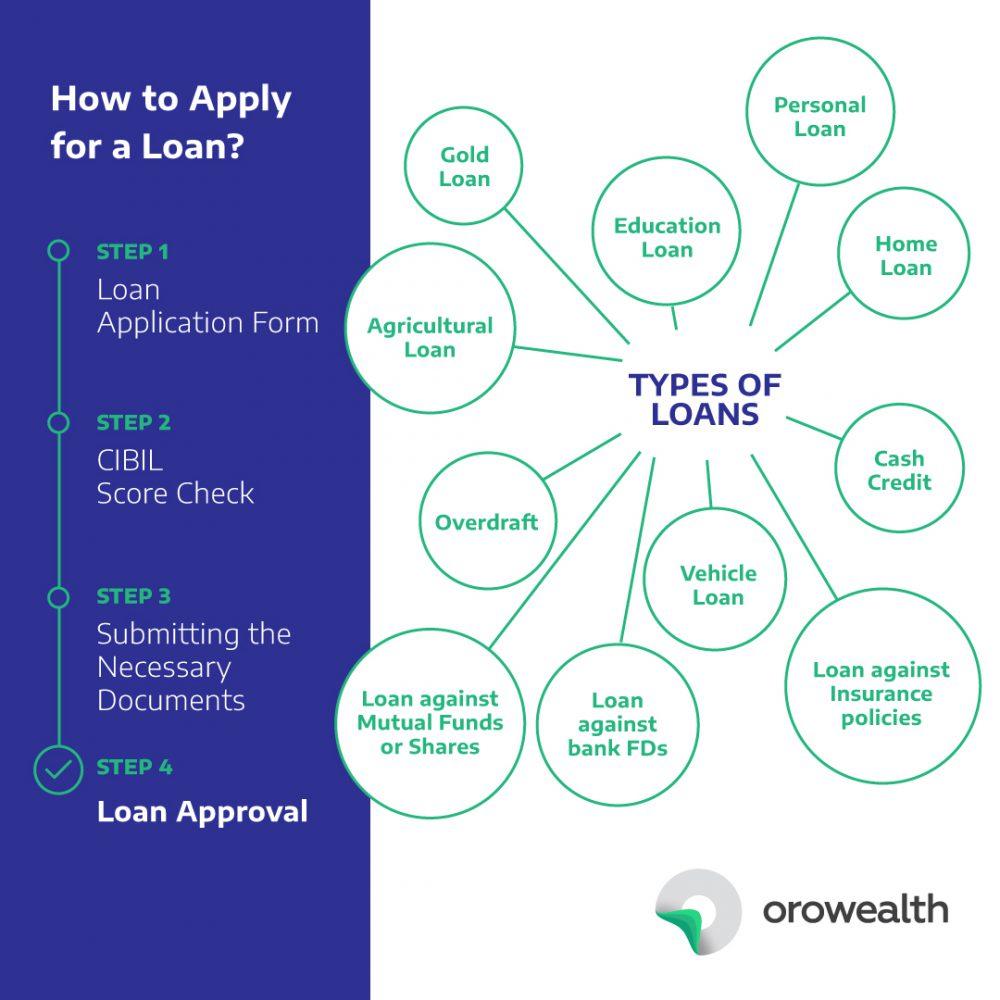

Focusing on how far domestic you really can afford try, needless to say, the initial step. Homes having Heroes has actually more 4,five-hundred skilled representatives and you can loan providers who’re dedicated to offering healthcare experts, also medical professionals and you can medical professionals. It is best if you glance at the kind of mortgage loans available on the market, what you are able qualify for, and you can just what will help save you some cash. This new five variety of money we will consider is:

- Old-fashioned loans

- FHA fund

- Virtual assistant finance

- USDA finance

Conventional Mortgage loans to own Doctors

Old-fashioned information states that every doctors may traditional home loans. Once the money is actually a button foundation, and you may physicians are generally high earners, Montverde loans it should be easy, right? Never. The doctors just out-of-school has actually a huge amount of beginner loan costs and not usually good credit results, so there are challenges.

Still, traditional finance are probably the first prevent if you are searching on fund. They are the best financial, with over 1 / 2 of most of the mortgage loans from conventional lenders. He or she is less strict when it comes to simply how much you can acquire therefore the qualifying requirements are very important. Traditional physician mortgage loans commonly supported by the us government such as the other financing sizes we will security. Alternatively, antique loans pursue recommendations set from the several private enterprises: Freddie Mac computer and you can Federal national mortgage association.

Particular Advantages of a normal Loan

- You could borrow doing you want provided your be considered.

- Rates of interest try negotiable for people who reduce activities.

- Down repayments try negotiable.

Some Cons of a conventional Financing

- Very conventional loan providers wanted a credit history out of 620 or better.

- In case your advance payment is lower than just 20%, you’ll want to spend monthly Personal Financial Insurance policies (PMI) for a few ages.

- For each and every financial commonly put their unique terms and conditions getting a home loan. There is no simple doc home loan bundle.

Antique medical practitioner mortgage brokers usually are located in a couple items: a 30-12 months otherwise an excellent 15-season name. At the same time, there are 2 sort of speed solutions: adjustable-price mortgage loans and you will a predetermined-rate mortgage loans.

Adjustable-Speed Financial (ARM)

A variable-speed financial (ARM) means the rate you only pay varies just after a fixed time period. Initially, your interest rate will continue to be an equivalent to the earliest step three-ten years. The rate with this fixed-rates period is normally below having a long-term fixed-rates financial. One plan is perfect for people that simply don’t intend to stand in their house for some time. Might shell out less cash in the focus due to their loan full. If you’re to get a property simply via your residency having the aim to help you modify to another family after, the brand new varying costs away from an arm might possibly be an intelligent move.

Following the fixed-price months, your own rate of interest tend to to switch monthly based on the market interest rate. It means the interest rate could boost or decrease considering the overall financial industry. However, the switching interest is the reason Hands are high-risk to help you consumers, and so they build cost management hard. 30 days their fee might be $1,400; the following day it could be a payment per month $1,800. Towards along with side, improved statutes adopting the 2009 casing drama set a limit on just how highest the speed can increase during the confirmed year that have varying speed mortgage loans.