Manage DCU Give Household Guarantee Loans if not HELOCs?

In the Expenses, we try so you can make economic alternatives with certainty. Regardless of if of facts examined are from the firms, and other people having which the audience is associated and individuals who compensate you, the recommendations are not dependent on her or him.

DCU now offers both house security financing and HELOCs. The fresh subsections below have version of here is how these items works and you will studies for the DCU’s equipment issues.

That is DCU?

DCU are chartered in 1979 indeed it is now among the many nation’s 20 premier borrowing from the bank unions. A switch to help you its grows is actually permitting since the borrowing connection to over 700 businesses and you can organizations. Of your stretching membership certification in order to set of this type of organizations and you may organizations as well as their loved ones people, DCU brings considering more substantial number of people throughout the nation.

Consumers victory whether they have a whole lot more solutions. And additionally financial institutions, borrowing unions depict great for some categories of borrowing. Specifically, this new Digital Federal Borrowing from the bank Relationship (DCU) offers more choices for customers looking for a home Shelter Loan if you don’t a house Ensure Line of credit (HELOC).

Credit unions are usually looked at as local, community-oriented organizations. DCU has expanded one to design towards electronic ages by using the on line coverage so you can serve more so many members around the the 50 claims. See DCU certificates web page to see an effective selection of having fun with organizations.

Borrowing unions usually bring most useful business than boat loan companies since they’re perhaps not-for-money communities. He could be owned by brand new users, hence in place of promoting income having outside investors, they run taking best financial conditions on the someone.

DCU’s highest registration eligibility criteria help to make it borrowing commitment generally readily available. That better make them advisable proper provided a great home Be certain that Capital otherwise a good HELOC.

- Manage DCI bring household shelter money if not HELOCs?

- DCU family ensure home loan

- DCU HELOC

- Simple tips to apply for DCU relatives security finance

- DCU pro and you may representative data

- DCU masters

- DCU disadvantages

- DCU selection

Key points to take on When looking for An effective DCU Home-based Collateral Investment

Property guarantee financial try a mortgage that makes use of the brand the fresh collateral on the possessions as the safeguards. New defense toward a home s the present day business worth of the house without the harmony of every current mortgage debt.

The total amount homeowners borrow secured on the worth of its homes is named the borrowed funds-to-worthy of ratio (LTV). And therefore adds the bill of every expose economic on the worth of new home security capital. After that it breaks you to in the house’s business value in order to dictate the LTV ratio.

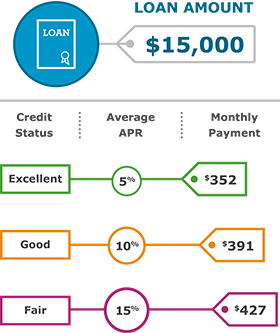

DCU keeps a max LTV ratio away-off ninety% to the house security money. Yet not, a debtor could get a better interest that have a good all the way down LTV ratio. Rates also differ predicated on borrower’s credit score.

Household security money could have fixed if not varying interest rates. Given that title implies, a predetermined price stays a just like the latest longevity of the newest the loan. That can function this new monthly obligations are exactly the same to the whole financing. DCU only has the benefit of repaired speed house shelter currency.

Along with LTV percentages and you will credit scores, security alarm money costs are and additionally according to the duration of one’s lent funds. Lengthened loans basically Houston Alaska payday loans hold high interest levels. DCU offers domestic equity resource a variety of times, ranging from five to 2 decades.

When you compare interest levels, a debtor should look to have fund predicated on lookup because of the the same matter, LTV ratio, home loan size, and you may credit rating. Since the individuals factors change lives the pace, it’s need use the same guesses discover an oranges-to-oranges assessment.