Precisely what does a 1% difference in home loan rate number?

Once you begin thinking of buying a house, you’ll pay attention to about home loan rates and exactly how much it sucks that they’re going up, how higher its if they’re dropping, otherwise why lowest https://paydayloancolorado.net/frisco/ mortgage pricing commonly always a good issue.

So how do you get to so it commission? And just how can it extremely apply to how much you only pay? On purposes of this particular article, I’ll check how merely a 1% difference between the home loan speed is undoubtedly affect simply how much your spend.

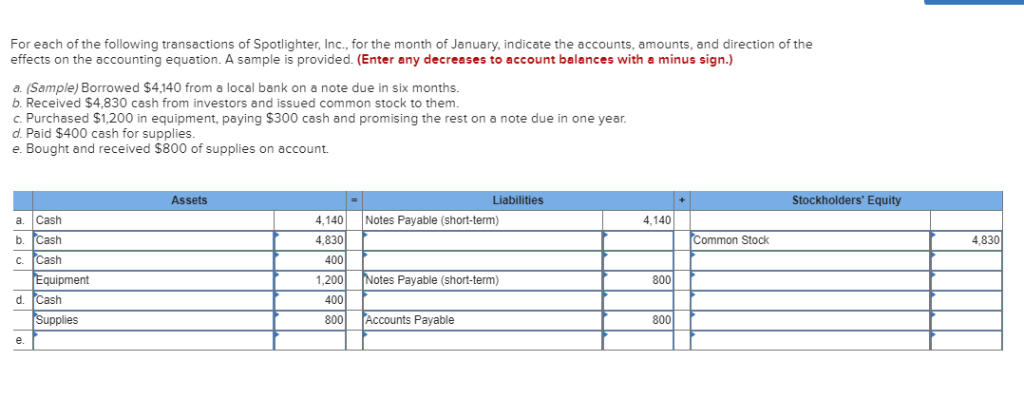

Given that you will observe throughout the dining table lower than, a 1% difference in an excellent $two hundred,000 house with an excellent $160,000 home loan expands their monthly payment from the nearly $100. Whilst difference between monthly payment will most likely not hunt that extreme, the newest 1% higher level setting possible pay everything $30,000 a whole lot more within the attention across the 30-year title. Ouch!

Just how home loan rates of interest works

Home financing is a kind of loan always get an effective house and other a property. The pace into home financing ‘s the percentage of brand new overall amount borrowed you will have to pay while doing so toward principal, or modern, amount borrowed.

The pace towards a home loan is frequently indicated because an annual percentage rate, or Annual percentage rate. Thus you will have to pay off the loan including attention costs throughout the life span of mortgage. The interest rate on a mortgage is repaired otherwise adjustable, depending on your own lender’s fine print.

For those who have a predetermined-rate financial, then your interest rate will not change-over the life regarding the loan. But when you enjoys a varying-rates home loan, then it can fluctuate in line with the Prime speed, such as for example.

How a-1% difference between mortgage rates affects everything you pay

Within this analogy, what if you are searching to carry out home financing to possess $200,000. When you get a 30-year mortgage and you create an effective 20% deposit of $40,000, you should have good $160,000 financial.

For folks who only set out ten%, you have a beneficial $180,000 financial. Another table shows you how much you’ll shell out – each other a month as well as living of one’s mortgage – from inside the for every condition.

*Percentage wide variety revealed do not include personal home loan insurance policies (PMI), which are often required towards the finance which have off payments of quicker than just 20%. The real monthly payment is higher.

Which computation in addition to does not include possessions taxation, which could raise the cost considerably if you’re for the a good high-tax urban area.

Inside example, a-1% mortgage price change causes a payment per month which is close to $100 highest. However the actual variation is how a lot more you are able to spend inside the attention over three decades…more $33,000! And just imagine, for those who lived-in new eighties when the highest mortgage speed are 18%, you would certainly be investing plenty a month just inside the attention!

What is actually currently taking place so you’re able to home loan costs?

COVID-19 pressed financial rates of interest right down to record lows, dipping so you’re able to a chin-losing dos.67% inside . Sadly, 30-season fixed financial cost features as ballooned in order to normally 8.48% at the time of .

But don’t end up being also bummed out. Consider you to back in the brand new eighties, a normal home loan speed are anywhere between 10% and 18%, and a beneficial 8.x% rates does not have a look as well crappy, comparatively. Naturally, the price of real estate enjoys increased since that time, but mortgage costs are still considerably below they might become.

The way to get a reduced home loan price

Unfortuitously, you don’t need to a great amount of private power over brand new average rates of interest offered by a day. Nevertheless possess quite a bit of power over the new pricing you are provided according to the average.