[Best Tale] ‘s the idea of a good paid-off financial still winking on your?

SIMON Brownish: I am messaging now which have Marcel Wasserman, independent economic and you may capital advisor. Marcel, We see early morning go out. You add away an email before about month regarding the investing regarding your home loan. It only was not throughout the any time you pay it back easily The new arrangement is always to repay it as quickly as possible seriously. However, you have another type of notion of carrying it out. As opposed to inserting the newest [extra] money toward mortgage account, you truly state, hang on, divert they so you’re able to assets alternatively?

MARCEL WASSERMAN: Morning Simon. Yeah, that is just therefore. Typically we done the newest wide variety and, funnily adequate, paying your property early is still a great, not into your home loan. Rather place [the income] on a good investment which increases on a higher level.

SIMON Brown: The idea up to they, I suppose, is the fact throughout the years and never the period and you may most certainly not to date from inside the 2022 your house mortgage is going to be X [and] you might possibly get a few even more commission affairs because of the placing it into a good investment. That which you next say is the fact at the conclusion of the newest several months, when you have adequate cash, carry it, repay the borrowed funds and get finished with it.

MARCEL WASSERMAN: Sure, just. It is important that folks discover or do not understand regarding the mortgage is they imagine its a kind of investment vehicle or a financing-loaning business.

The better option is to get into this new habit of performing your own investment automobile, your own loans that you can withdraw away from, not just to pay off your home however, doing all sorts of points that you might need to resolve this new rooftop that version of some thing rather than playing with a loan business.

SIMON Brownish: We bring your area. Additional point you’re claiming is the fact part of the issue is we buy our home financing, we dip into the, i grab the money, but what we have been and creating was our company is to acquire the fresh new homes. I carry on updating otherwise downgrading our very own home and now we enjoys a aim, but we never ever have that mortgage reduced.

MARCEL WASSERMAN: Yeah. That is the bad. I am also responsible for one to me. You manage choose the home, as if you said, therefore in fact diligently start investing it off 10% more thirty day period and you maybe alive truth be told there 10 years. Now the youngsters has actually maybe grown up otherwise gone out the house or something like that has evolved and you also check out a unique town. If you get towards the brand new set maybe not also a costly domestic you realise, oh better, I might in fact eg a double garage. I’m going to pay for that me. I wish to installed a share, without a doubt. For folks who research once more, all the money you’ve spared to repay your house very early you have now spent on upgrading the house once again.

SIMON Brown: I have seen you to. My personal sister’s amazingly patient during the setting aside the money, upcoming this woman is always, since you say, upgrading the pool or something right here or something indeed there.

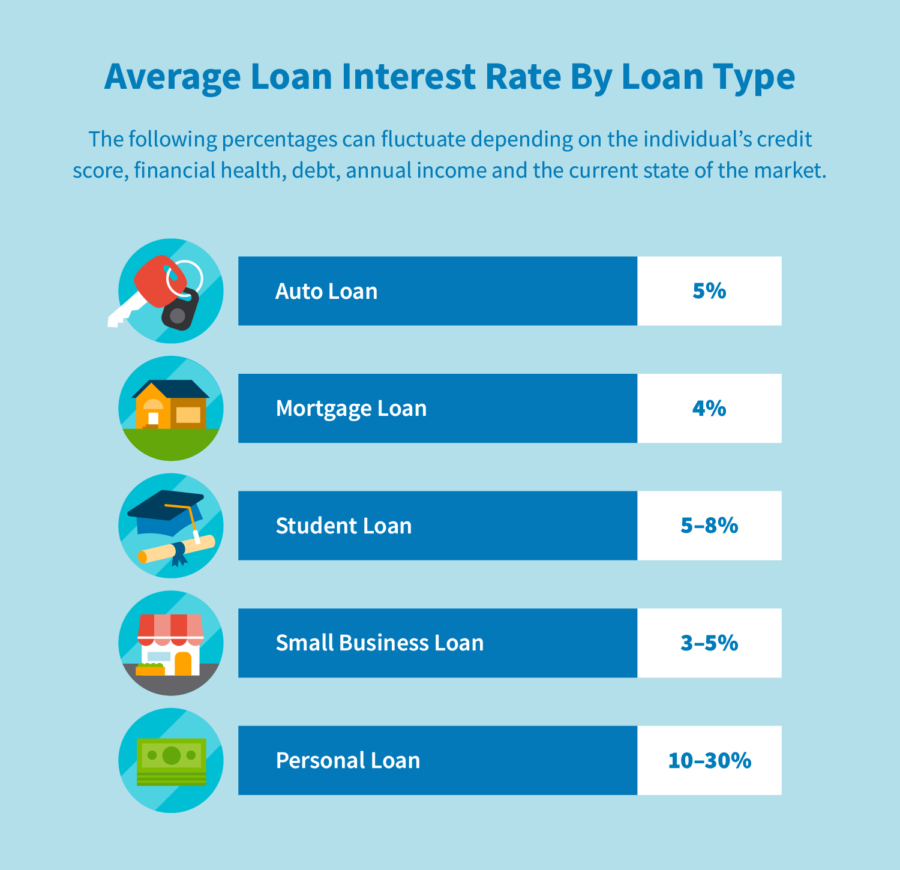

In addition make point you to definitely, doing you want to pay back our house loan as fast as possible for many people it will likewise become from the an effective long way the greatest obligations its good financial obligation in such a way. It’s not the latest horrors of costly mastercard otherwise personal debt.

MARCEL WASSERMAN: Yes, this is exactly correct. So that your financial, ways its determined try it is rather, very cheap loans, very good personal debt for the reason that feel. However, at the conclusion of the day, even in the event, one must nevertheless be careful. Obligations remains debt. Whilst enough time just like the you may have a great bundle like I will pay back which family; with this particular home which is are paid down, they advances my personal earnings at the conclusion of the latest day’ next we have been entering the right area. But when you need to carry on leasing, you might never enter into that lay where you’re probably going to be able to alive of or perhaps be when you look at the a secured item the place you indeed is alive. You don’t have to shell out more book which is why We state its an excellent debt because it places you in the a great better updates than ever you got that loan.

SIMON Brown: And our house has actually correct energy. One other argument nowadays, the conventional skills hence You will find never appreciated, however, You will find never really had a quarrel against, it really naturally generated no sense in my opinion people pays off their residence financing and hop out R10 in truth be told there and so they upcoming contain the account discover. I’m not sure as to why because the, if very little else, banking companies are going to ask you for charges as banks such as charges. You state, pay it off then intimate financing [and] walk away.

MARCEL WASSERMAN: Sure. This is real. This really is once more a misunderstanding available to choose from. That’s how they profit. Just what the individuals do try they’re going to pay the last premium inside the, immediately after which they are going to withdraw it, and spend they from inside the right after which withdraw it to save one studio open for the an accessibility thread, meaning capable do the entire number of the connection and you can they can spend they when they such as. They can practically just import it in their private account.

Usually people do not intimate financing off and then, because you say, they dip into it and you will abruptly it’s not paid off

The main benefit are it is tax-free since it is a loan, however the drawback are it is that loan. Really don’t want to have borrowing from the bank all the living. And so the most useful suggest carry out is repay it. Consider, you’ve kept the latest house. So if you extremely, want money, you might nonetheless come back and simply refinance your property otherwise rating a loan against your home if you don’t meet the requirements as the you don’t have a paycheck, even then you can however [take a] mortgage facing your property because it’s repaid. It is a secured asset.

I happened to be creating the new numbers yesterday: even after Covid along with Ukraine and all these items heading toward, we have https://cashadvanceamerica.net/300-dollar-payday-loan/ been still sitting around ten% average progress for the average healthy fund.

Definitely financial institutions and so are attending hate me to have claiming which, I give them a hard time financial institutions need you to have the mortgage

Very alternatively exit your bank account in there, get 10% most a-year rather than spending your own 9% on your own currency.

SIMON Brownish: Yes. And take off that enticement to visit and create a double driveway or maybe bring a holiday someplace or something. Its 2 decades and you are however purchasing money.