Brief Remark: What exactly is property Equity Loan?

A house equity mortgage gives you a single lump sum payment away from currency you need however you favor. Such as for example, a home guarantee financing is the ideal to settle highest expense such as student loans, combine higher-attention expense, or finance a massive event instance a wedding or dream travel.

Today with that meaning less than our straps, why don’t we look closer in the great https://paydayloansconnecticut.com/moodus/ things about a home guarantee credit line.

Exactly what are the Benefits associated with Family Security Personal line of credit?

Perhaps the most useful advantageous asset of a house security credit line ‘s the flexibility it provides, more than both the loan equilibrium and you may attention pricing. Plus, they give you effortless, ongoing accessibility bucks-a lot like credit cards. Such lines include lower variable rates that will change along side life of their line.

How do i Use property Equity Line of credit?

Some great benefits of a home security credit line are similar to people out of a home collateral financing. Have a look at after the that are just some of the fresh new gurus which may be of interest to you personally in this phase of your own monetary lives.

- Manage a house Upgrade Project: If you have the cardio set on a remodeling your kitchen otherwise dream of a different sort of deck, a house equity credit line can help generate men and women desires possible.A home security personal line of credit is specially good for an effective investment for which you can’t afford to accomplish everything you immediately, and instead have to tackle you to enterprise simultaneously (versus a job the place you be aware of the accurate number, we.age. a home redesign, in which case a home equity loan can make a lot more sense).

- Create a big Orders: Once the a property security credit line fundamentally functions as a great charge card, thus you can utilize make use of these loans to have a huge pick, we.elizabeth. trips, purchase another type of automobile, etc. Alternatively, it may be worthy of examining additional options to have large instructions, i.e. a secondary Mortgage.Eg, Western Lifestyle Borrowing Relationship even offers travel money to possess people whom could possibly get has actually lower income or reduced fico scores, and easy you prefer that loan as high as $1,two hundred when it comes down to june so you can-2.

- Consolidate Loans: Other advantage of property collateral personal line of credit is the fact it could be used to consolidate debts in order to a lesser rate of interest, and you may residents can sometimes fool around with home collateral to repay almost every other private expenses including a car loan or a charge card (Bankrate). One-word off alerting for those who go down this station-be sure to work to have the personal debt off when you make use of home guarantee line of credit, in order to consistently change your credit rating.

Just how are property Guarantee Line of credit Unique of an effective Home Equity Mortgage?

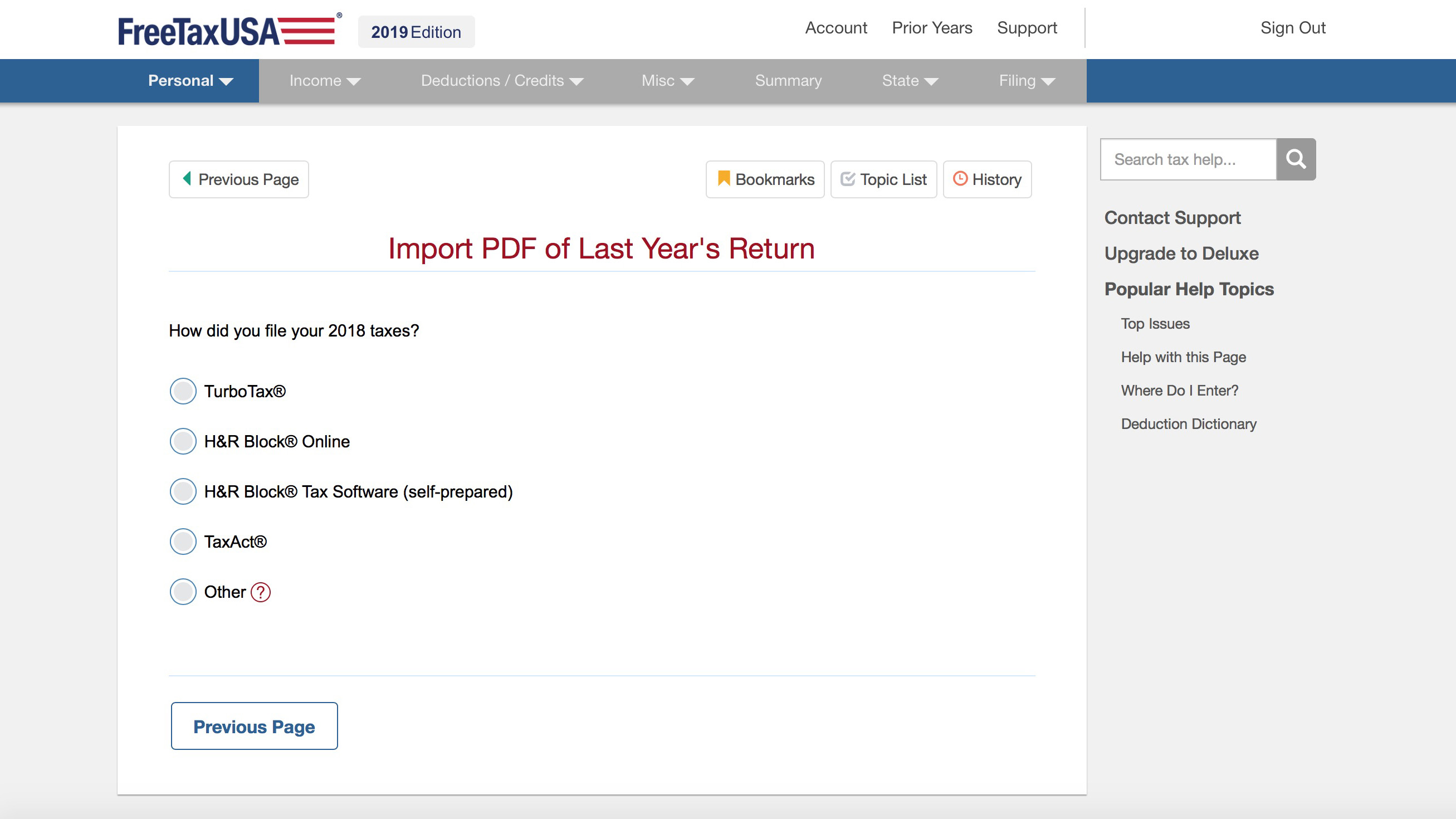

![]()

In a nutshell, a house collateral financing will provide you with a lump sum off money you need to pay more than a lot of time via repaired monthly premiums. Property security line of credit (HELOC) is different in that it works way more much like a credit credit.

An excellent HELOC enables you to get approved to have a specific amount, where you can only borrow what you would like… and you may obtain many times after you become approved. In early many years, you are able to less repayments, but at some point, you have to start making totally amortizing money you to take away the loan (The bill).

Where Must i Rating a house Guarantee Mortgage or Domestic Equity Credit line?

As with any large lives decision, it is necessary that you go with a source that you believe. This is why the audience is committed to top providing our very own local community and working with the members in order to browse financial conclusion, such as home equity solutions, when it comes time. Peruse this web page that gives additional information towards domestic collateral finance and you may domestic equity personal lines of credit.