The benefits of being #XeroCertified

We are Remote Expert Accounting, Legal, Tax, and Audit Advisory Service Providers. See how to get listed in the Xero advisor directory and how to make the most of the opportunity. Xero champions are firms whose team members have completed the most Xero training and who are growing fast.

Interested in becoming #XeroCertified to make sure you’re getting the most out of Xero? Join the 100,000+ #XeroCertified individuals globally and start your learning experience to certification here. The fees for registering for the Zero Advisor Certification exam are INR 1500 + GST. Candidates can pay this fee using a credit card or through net banking according to their liking. It is essential to note that this fee is non-refundable under any circumstances, and candidates will not receive a refund if they fail to appear for the exam. Additionally, if a candidate wishes to reschedule their exam date after submitting their registration form, they must pay an additional INR 1000 + GST fee.

How to Become Xero Advisor Certified? Benefits, Cost, Test of Xero Advisor Certification

We offer a fixed pricing structure – no hidden costs so no bill shock at the end of the year. Xero certification means that some or all team members have completed courses and been assessed by Xero as proficient in the use of the Xero application. We don’t review advisor listings and we don’t recommend or guarantee receivable turnover ratio the service provided by any one advisor, so make sure you check them out yourself and get comfortable with them yourself. AAA REALTAX specialises in working with some of those banks; they can help with setting up bank feeds, and are knowledgeable about accessing bank loans and streamlining payments through Xero.

All firms listed in the directory have staff members trained in Xero and eight or more clients on Xero. This was everything related to How to Become Zero Advisor Certified. Xero partner Georgia Goodman from Leech & Partners has been #XeroCertified for seven years. “For me, being #XeroCertified means we’ve put in the time to educate ourselves on Xero.

Xero welcomes new members to Aotearoa New Zealand’s Partner Advisory Council

Working with diversified businesses helped sharpen my accounting skills. We are providing affordable remote accounting and related services. Take a self-pace certification course, attend a webinar or take the fast-track assessment to complete your certification.

- First Class Accounts (Nelson) serves clients who use 1 different app that connect and integrate with Xero.

- Xero partner Georgia Goodman from Leech & Partners has been #XeroCertified for seven years.

- Xero doesn’t assess any individual advisor’s or firm’s proficiency as an accountant, bookkeeper or financial advisor.

- Xero certification can be completed through online courses, a live webinar or a fast-track Xero advisor certification.

- It also includes other unspecified costs like a Xero subscription fee, a practice management system, and marketing materials.

- First Class Accounts (Nelson) can help make your switch as smooth as possible.

Xero is a cloud-based accounting software and Financial professionals who work with small businesses can manage their finances securely and more efficiently. With Xero’s accounting software, you can easily commit to providing excellent service to your clients. Gaining a Xero advisor certification will give you valuable skills that allow you to offer Xero services to clients. An accountant and bookkeeper who is a Xero certified advisor will be properly educated on the Xero platform and able to perform Xero services efficiently and effectively. As such, they’ll be able to offer a better service to clients seeking advisors proficient in Xero, and ultimately add to the existing services provided by the firm.

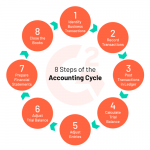

You can use badges in physical and online marketing material to promote your practice’s Xero partner status, certification status and your individual expertise. Xero doesn’t assess any individual advisor’s or firm’s proficiency as an accountant, bookkeeper or financial advisor. And Xero certified advisors and advisors with industry or bank specialisations are not employees of Xero. To become certified, advisors complete learning modules on Xero’s key features and pass a practical exam. Xero certification can be completed through online courses, a live webinar or a fast-track Xero advisor certification. I am providing remote bookkeeping and accounting services for the last 3 years.

Meet the team

In response to your feedback last year, we’ve already implemented some exciting changes to the live product update webinars for this year. Our webinars will now include tips specifically for our partners to get the most out of Xero, chances to win spot prizes as well as guest appearances from Xero leaders. Xero partners receive digital badges when they reach a certain status level, or if their staff have completed Xero certification courses with specialist badges.

- First Class Accounts (Nelson) works with businesses across a range of industries.

- I am providing remote bookkeeping and accounting services for the last 3 years.

- The fees for registering for the Zero Advisor Certification exam are INR 1500 + GST.

- They specialise in helping to choose apps that integrate with Xero to boost business performance for some of those industries.

Xero’s Advisor Certification is a learning experience that helps our accounting and bookkeeping partners become proficient and confident with Xero’s core features. You can complete certification in the way that best suits your learning style and your previous knowledge of Xero. Choose from online courses, a webinar, a live classroom or if you already know Xero well you can take our fast-track assessment. Once certified, you’ll receive an official certificate to show your clients that when you say you’re an expert in Xero – you really mean it! To maintain your certification, you’ll need to complete the four quarterly product updates each year.

000+ students realised their study abroad dream with us. Take the first step today.

Look for a bookkeeper or an accountant near you in the Xero advisor directory, or use our match-making tool to find the perfect pair of hands. Step 7– Once you complete the lectures and you feel confident enough you can apply for the exam which is called “Fast Paced Assessment”. This online exam will consist of 50 multiple-choice questions which needed to be attended within 2 hours and it is compulsory to attend all the questions.

Study Online

Xero is beautiful online accounting software for smaller businesses. First Class Accounts (Nelson) can help make your switch as smooth as possible. Xero specialisation means that some or all team members have completed several short learning modules to develop skills in that area. Collaborate with your peers, support your clients and boost your practice. Your accountant or bookkeeper can be a valued business advisor so check what to look for when you choose one.

New to Xero? First Class Accounts (Nelson) can help

If you’re already one of our #XeroCertified partners, you will receive an invitation to the first quarterly product update for 2022. Remember, you need to complete all four updates for the year to maintain your Advisor certification. Looking to the future, Xero certification will continue to evolve to make sure our partners are getting the best education possible.