Cost terminology differ by the lender, but many loan providers offer words ranging from a few so you can half dozen decades

A house upgrade financing is a kind of personal loan you to enables you to borrow cash away from a loan company and pay they back each month more a-flat installment term duration. The quantity you qualify for and interest rate in your personal financing depends on your borrowing from the bank reputation and other situations.

Signature loans are typically https://paydayloanalabama.com/babbie/ repaired, many lenders manage provide varying cost

Certain lenders render prolonged terms and conditions having do it yourself funds, often doing twelve years. By firmly taking aside an unsecured loan, finance are usually taken to your immediately – when the exact same big date, or within this two business days.

This is exactly different from most other money that can easily be applied for to have home improvement systems, including domestic security finance and you will credit lines such finance use your home just like the security.

Still, specific unsecured loans are covered, and additionally they require you to install security. Equity is an activity useful, including cash offers, a car or truck, or even property, that is used so that the financing. While you are struggling to build repayments in the future, possession of your own equity get solution away from you into the bank.

- HELOCs, otherwise home equity personal lines of credit, are lines of credit applied for with your family due to the fact equity. With HELOCs the financial institution believes so you’re able to give your a max count contained in this confirmed identity size, entitled a suck several months. A borrower are able to use as much otherwise very little of that limitation number as they need from inside the mark time of the line of credit, then have to pay it off straight back from inside the payment period.

- Domestic equity financing are a lot eg HELOCs but the amount of the mortgage is determined during the app processes which can be financed towards the borrower in one single lump sum shortly after acceptance. Since HELOCs and you may house security money use the house given that collateral, the lending company will most likely require an assessment of the property prior to approving the loan matter.

- Unsecured loans removed having do it yourself commonly normally backed by your house, which function there was a simpler acceptance process and you may smaller investment without any likelihood of dropping your property if you struggle to pay back the borrowed funds at some stage in this new coming.

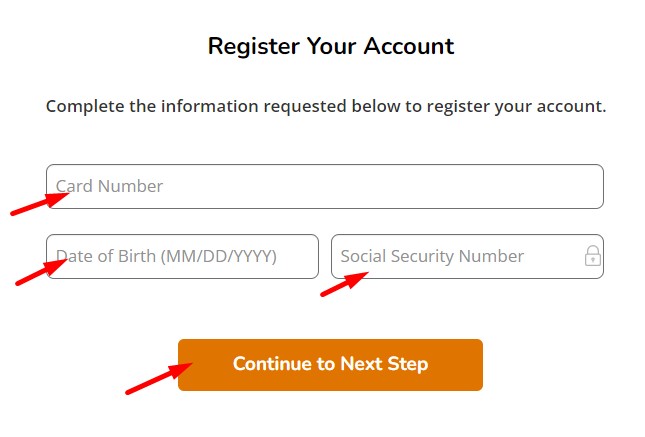

Delivering an unsecured loan is usually a fast and simple process compared to the other types of money eg HELOCs, house collateral loans, and you can mortgages. Really loan providers enables you to check your price and you may prequalify instead of any affect your credit rating – you may also view numerous lenders at once that have Purefy’s tool.

Once you have prequalified, you might complete your application on the web, which usually takes lower than 15 minutes. The financial institution will run a hard credit score assessment and may consult support paperwork instance a good paystub otherwise tax returns. If for example the loan is eligible, the lender tend to usually electronically transfer the funds directly to your own family savings.

The process would be completed in any where from an identical big date for some business days, depending on the bank, plus certification.

A predetermined rate financing is interested speed that wont change-over date, meaning your own monthly payment could be the exact same on the lifetime of your own loan.

The most famous brand of unsecured do-it-yourself financing try good personal loan, which generally has no need for that build any equity

A variable price loan, additionally, has an interest speed that will fluctuate having markets prices. They are usually associated with the latest Shielded Immediately Funding Rate or SOFR directory. In the event that field costs go-down, your speed and you will payment will go off, however, if industry cost go up, therefore have a tendency to the speed and you will fee.