Home loan Versus House Loan: Whats the difference?

Regardless if you are an initial-big date homebuyer or perhaps not, financing is an important situation it is wise to understand and you will thought prior to making a purchase. Of a lot purchase plots both getting financing or even to create property. This is how brand new confusion regarding trying to get a home loan or a plot mortgage pops up. When you are to purchase property otherwise plot of land might not check all that dissimilar to of several, because you might be essentially to shop for assets in both cases, you can find variations with respect to the newest fund part of it.

Basics from home financing and you may homes financing

A mortgage is normally available for qualities which can be either below design, having ready characteristics, or home expected to become created later on, whether it’s property otherwise a condo. Likewise, an area loan, known as a plot financing, was availed when buying a parcel that’s heading for use having strengthening a home or for money intentions. The brand new house have to be exclusively useful home-based purposes.

Basic, the newest parallels

Before getting to your variations, you should consider exactly how home financing and you can residential property loan try the same as one another. By Arkansas title loans way of example, whether you submit an application for a mortgage or homes mortgage, the fresh due diligence procedure is basically an equivalent. Due diligence try a system off research and you will investigation where lender tends to make an informed choice whether or not to lend money into the borrower or not.

Yet another trick similarity is the eligibility requirements. This can be basically a comparable regardless of just what loan your sign up for. Also, rates therefore the overall app procedure wouldn’t disagree all of that much either. And, needless to say, a component that will play an important part on app process is your credit rating. This really is given benefits whether it’s to own a home or plot loan.

But exactly how are they various other?

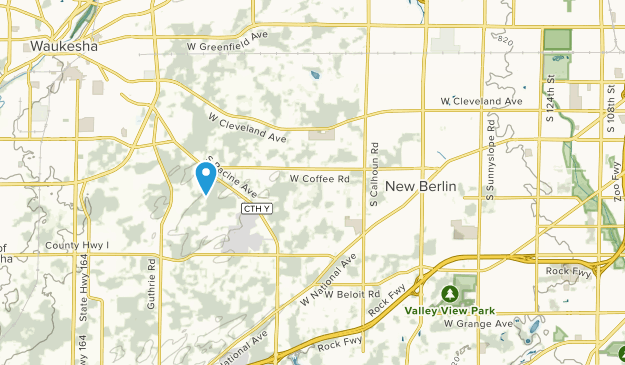

Among the key distinctions is the area. That have home financing, you can aquire property anyplace of your preference. It is not the way it is for an area loan. With an area financing, the property have to be discover inside the town or business constraints. That is out of secret characteristics to remember just like the you look for a property inside the a place that can remain you eligible for the mortgage you might need.

Since the tenure getting an area mortgage is all in all, fifteen years, the new tenure getting a mortgage is significantly lengthened, going up to help you thirty years. If repayment is a big grounds, this time is an activity for taking for the consideration. Furthermore, when you are availing regarding that loan thinking about the latest taxation professionals, you should observe that tax write-offs will be availed with a good mortgage, however an area financing. Income tax write-offs are just qualified to receive a loan that’s been taken to construct a home toward a story. The tax deduction can simply be reported pursuing the construction features become accomplished.

There are many variations in the two type of financing such given that an enthusiastic NRI to be able to score a mortgage, but just a citizen Indians to be able to get an area mortgage. An area financing entails that homes cannot be located in an industrial urban area otherwise community and cannot be employed to purchase farming house. However with a land loan, you can get properties away from regulators developmental authorities, away from present cooperative property societies/apartment owners’ connections, or belongings mainly based of the individual property owners.

Prior to purchasing assets, make certain you happen to be well-told in order to make greatest decision which can show the very best for you fundamentally!