It’s showing up in prices, underwriting, and mortgage terminology

Its showing up across the board out of large banks, borrowing unions, and you may less independent lenders and you will we are enjoying it enjoy out round the every borrowing from the bank areas

So that as the fresh new aggressive ecosystem continues to progress, we are focused on the newest self-disciplined delivery of our strategy. And you can the core philosophy from maintaining large strength and you may getting exactly what the business provides remained intact. You understand, within underwriting, we generated conventional presumptions and you will guess quick normalization off auto thinking so you’re able to a lot more renewable account. Very, there is kind of two contending something happening on auto business that type of — which drives the outcomes you look for.

A person is growing battle, that’s extremely understandable as the the — every automobile player provides published, you know, really strong yields and you can desires to attract more of these. You will find some signs that we improve an eyebrow and work out certain that we come across, you realize, voice underwriting around obtainable. However, we also provide — our very own opportunity is differentially getting along with running on all of our tech possibilities that people has actually throughout the automobile providers. Such things as Automobile Navigator, things like our experience of brand new investors, in addition to their dependence on our very own technology to assist them underwrite ideal and sell trucks more rapidly and you can effortlessly.

So, the net of these a couple of pushes has actually provided me to post other extremely solid quarter that we have been bending in regarding the auto team, but we need to all the discover we should be wary of in which industry is certainly going. While having, keep in mind that the entire world alignment, will eventually, people globes won’t be because the aimed as they were.

An excellent nights. Thank you for taking my personal issues. Just to follow up to the some of the competitive dynamics you explore, specifically for fintechs. After all, have you contemplated, you understand, perhaps a great deal more revolutionary alter, whether it is getting the fintechs to speeds your growth otherwise their competitive, you are sure that, status on the market, or probably trying to write far more significant efficiencies within this Financing That so you can, you are sure that, develop to address the newest competitive ecosystem inside fintech?

Disappointed, I found myself toward mute around. Disappointed to your silence. Many thanks, Kevin, to your a question truth be told there. As we have said with the enough period, the latest banking business — by the way, measure matters much.

And by just how, yet not crucial level try in years past — and also by the way, because a person who been Investment One thirty years back, and you can I’ve constantly worshipped to the altar away from size, and it’s really been a tough travels since the we didn’t have the fresh new measure for many of time and another that is always reminded regarding how a great deal more size carry out help. You understand, financial institutions — all of the banking industry is, I think, attending to a great deal on purchasing other banking institutions to create an extremely important measure. On Funding You to definitely, we are not deciding on lender purchases. We’re strengthening a nationwide, I mean, you realize, by-the-way, we performed much more bank acquisitions inside our previous that have been most essential in putting you within the good reputation out-of tolerance level on the financial globe.

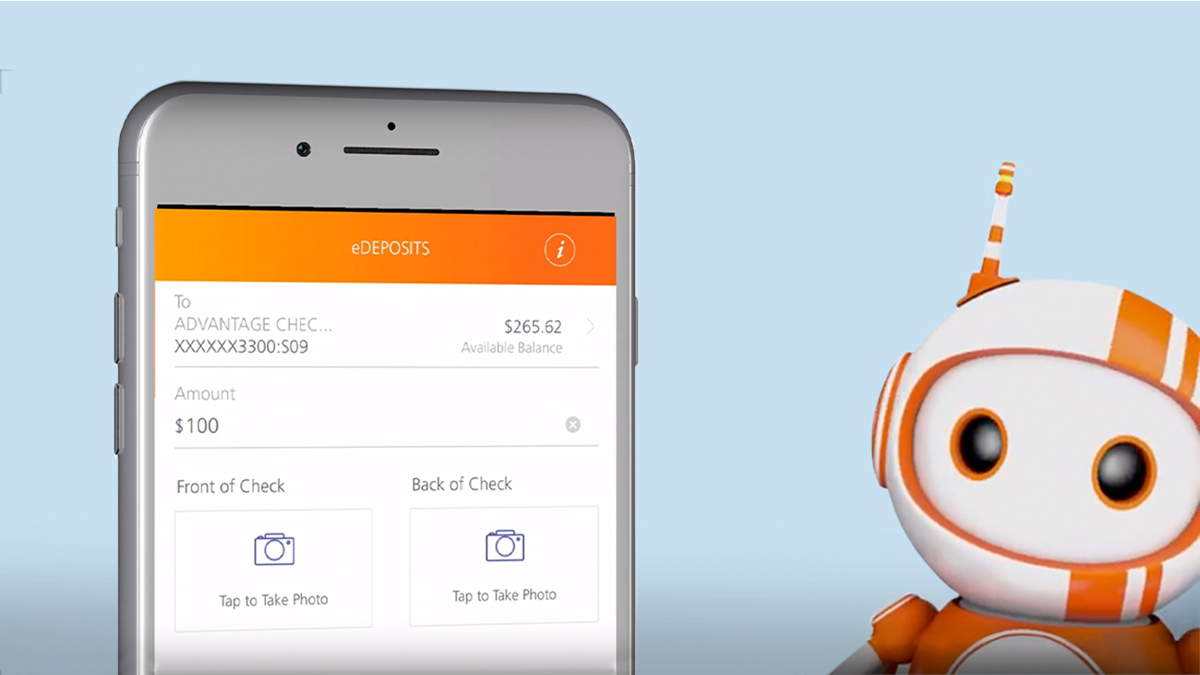

However, where we have been concerned about the newest financial top is actually strengthening a national digital lender. That will be most gonna be an organic quest. No enterprise enjoys actually extremely created one to naturally, however,, you are aware, we like where we have been and we also eg our very own chances. The buy desire wants within technology businesses at fintechs.

And some lenders has prolonged beyond its prepandemic credit package

And you may, you know, I mentioned each of those people. We have complete acquisition of technical companies in which he has got particular of one’s technology possibilities you to our company is building and since we express an identical technology heap that has been an appropriate action to take and you will an accelerant. Right after which, obviously, we have been deciding on fintechs, and Resource You’ve got complete numerous people acquisitions inside for the past also. I — it isn’t lost with the all of us, my site this new amazing valuations why these enterprises demand.