Just how foreigners will get a mortgage for the Southern Africa

Post conclusion

- People from other countries or nonresidents normally invest in possessions during the Southern area Africa because individuals, otherwise through joint possession or of the acquiring shares into the an entity one to possess property.

- Nonresidents need certainly to transfer 50% of cost otherwise equilibrium regarding price through the Set aside Financial, off their very own international bank to help you a selected account (that usually end up being the faith account of the going lawyer) with a subscribed Southern African bank.

- Most of the people from other countries, especially nonresidents, need invest you to rand in the country for each rand they must acquire. The amount people from other countries or nonresidents can be use is restricted so you can fifty% of one’s cost.

The Southern African possessions industry continues to be a prime appeal getting foreign people, courtesy a favourable rate of exchange and you will lots of luxury homes within the scenic urban centers. International funding is expected to further improve as the cost savings gradually recovers on Covid lockdowns.

What to discover lenders to have foreigners when you look at the Southern area Africa

Foreign people perhaps not citizen when you look at the Southern Africa, that are eager purchasing possessions here, will perform thus actually or as one, otherwise because of the obtaining shares from inside the a buddies this is the inserted owner off a property.

step 1. If you purchase possessions because of an estate representative, they have to be a registered member of the Estate Agency Affairs Board which have a valid Fidelity Fund Certificate.

dos. When you make a deal purchasing and is also installment loans no credit check Columbus MT recognized, a contract out-of selling could be drafted to the visitors, seller as well as 2 witnesses so you can signal. This offer is legally joining. In the event the often the consumer otherwise vendor cancels the brand new agreement from the 11th time, they may be sued having expenditures obtain, particularly wasted court fees.

3. Both give to acquire together with contract out of marketing need becoming fully understood just before they are closed and you can recorded. You need to look for separate legal services if the something was undecided.

4. Possessions from inside the South Africa comes voetstoets (as it is). Yet not, the consumer have to be told of all of the patent and you may hidden flaws about property.

5. Accessories and you will fittings are instantly included in the income of your own property. For clearness, these could getting listed in brand new arrangement off product sales.

six. Electric and beetle certificates have to confirm that the electronic installations try compliant with statutory criteria and therefore the property is perhaps not plagued because of the specific beetles. (The latter certificate is often only mandatory within the coastal places.) Particular countries require plumbing and you can gasoline certificates.

7. All the foreigners not resident otherwise domiciled in Southern area Africa need purchase that rand in the country for every rand they should use. The quantity foreign people or non-owners is also obtain is bound so you can fifty% of the purchase price. Approval are required because of the exchange manage government, that’ll rely on being able to establish the addition to Southern Africa from an expense comparable to the connection loan amount.

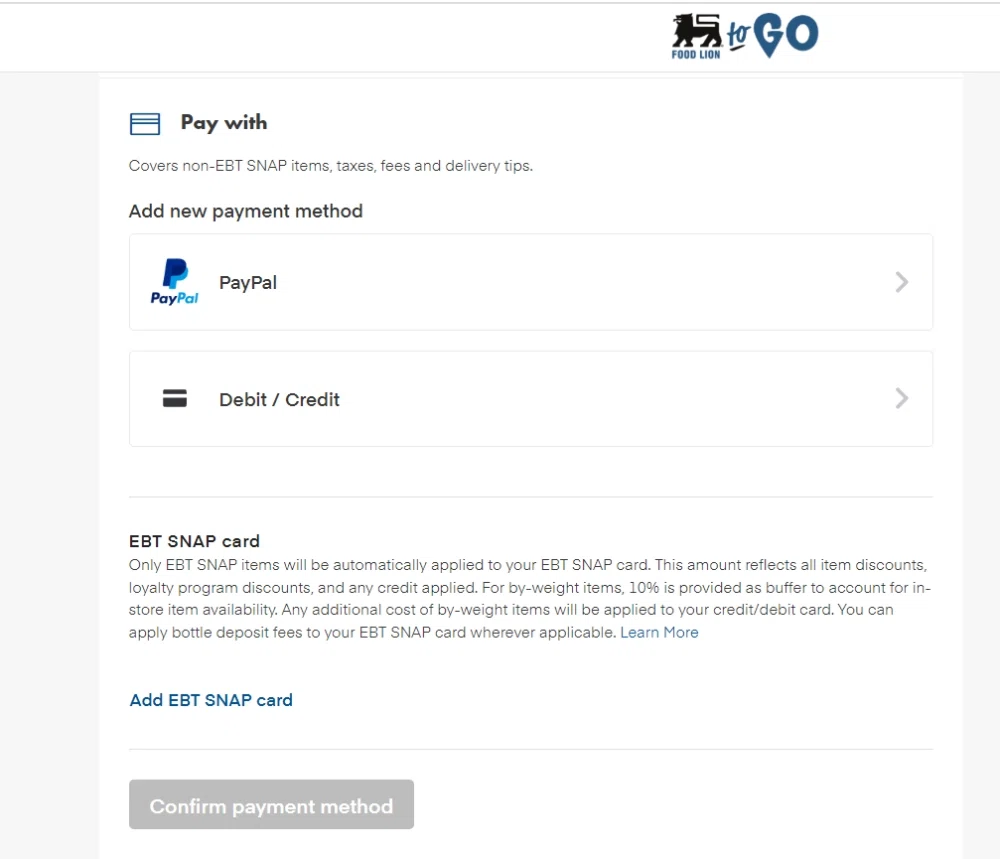

8. Banking institutions simply finance 50% of your get value of the property to own nonresidents. Very foreign dealers will both need certainly to render an effective fifty% deposit, otherwise shell out bucks and you can introduce an entire amount to the Southern Africa via the Set-aside Lender so you can a specified savings account (which will always function as the trust membership of going attorney) which have a subscribed South African lender.

nine. Brand new number of one’s deposit of your funds acquired from a beneficial overseas provider is known as a good package acknowledgment and must getting hired by the buyer because it’s needed toward repatriation out-of financing in the event that home is fundamentally marketed.

10. If it is a joint application, at least one applicant have to earn at least R25 100 per month, end up being 18 ages or old as well as have a definite credit record.

What data can i you desire whenever making an application for a home loan just like the a different buyer?

- A person Mortgage Interviews Function, finalized and you may dated. Rather you could potentially complete an online application which have ooba Home loans:

- A copy of ID otherwise each party from a keen ID Cards Or a foreign otherwise South African passport Or a work permit letting you work overseas.

- A paycheck Suggestions Otherwise an effective payslip into the current six months (around submission date).

- A duplicate regarding the full Deal off A job.

- A client Mortgage Interview Function, closed and you may old. Instead you might over an internet app which have ooba Home loans:

Making an application for a mortgage as a consequence of a-south African bank

ooba Mortgage brokers was Southern area Africa’s premier financial investigations services, and will let foreign people to order property for the Southern Africa once they make an application for a thread as a consequence of a-south African financial institution.

Audience you should never always need certainly to open a bank account having that commercial bank, as they possibly can import finance directly from their to another country account to your their home mortgage membership.

We are able to fill in your application so you can several South African financial institutions, allowing you to evaluate packages and also the best bargain into your house mortgage.

We provide various tools that will improve property procedure simpler. Begin by the Bond Calculator, following fool around with all of our Thread Signal to see which you really can afford. Ultimately, when you’re ready, you might apply for a mortgage.